Donald Sterling’s payday: 15,900% return on Clippers’ investment

- Share via

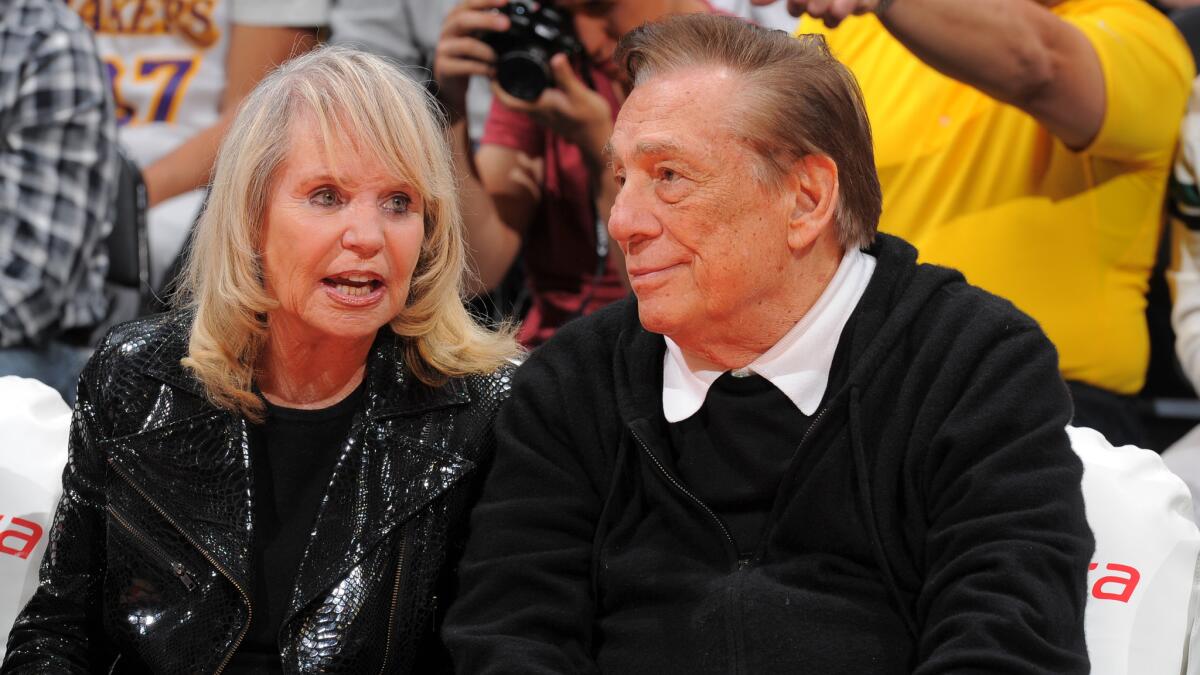

Donald and Shelly Sterling are about to get a huge payday. The sale of the Clippers to former Microsoft CEO Steve Ballmer was approved for $2-billion on Wednesday. Mr. Sterling bought the team for $12.5 million in 1981, which means he will be getting a 15,900% return. Not bad.

That got us wondering, what else could we buy that would provide a large return on investment? Here are other "sure-fire" ways to spend your millions:

Norman Rockwell’s “After the Prom”

934% return on investment

Bought: $880,000 in 1995

Sold: $9.1 million in 2014

Art, be it fine or popular, can appreciate nicely. Norman Rockwell has undergone a major financial reappraisal in recent years. "After the Prom" sold at Sotheby's on May 21, 2014.

Downtown Carwash in Los Angeles

2,523%

Appraised: $953,000 in early 1980s

Sold: $24 million in 2014

A carwash? Really? Yes – especially if it's located in a booming downtown Los Angeles. The original owner, Robert Bush, rejected multiple offers over the years and finally sold to Los Angeles landlord Ben Neman.

Los Angeles Clippers

15,900%

Bought: $12.5 million in 1981

Sold: $2 billion

1962-1964 Ferrari GTO

17,233%

Estimated price: $300,000 in 1981

Sold: $52 million in 2013

Only 39 were produced and when new, they sold for $18,000. It was reported that the most coveted car in the world recently changed hands in a private sale.

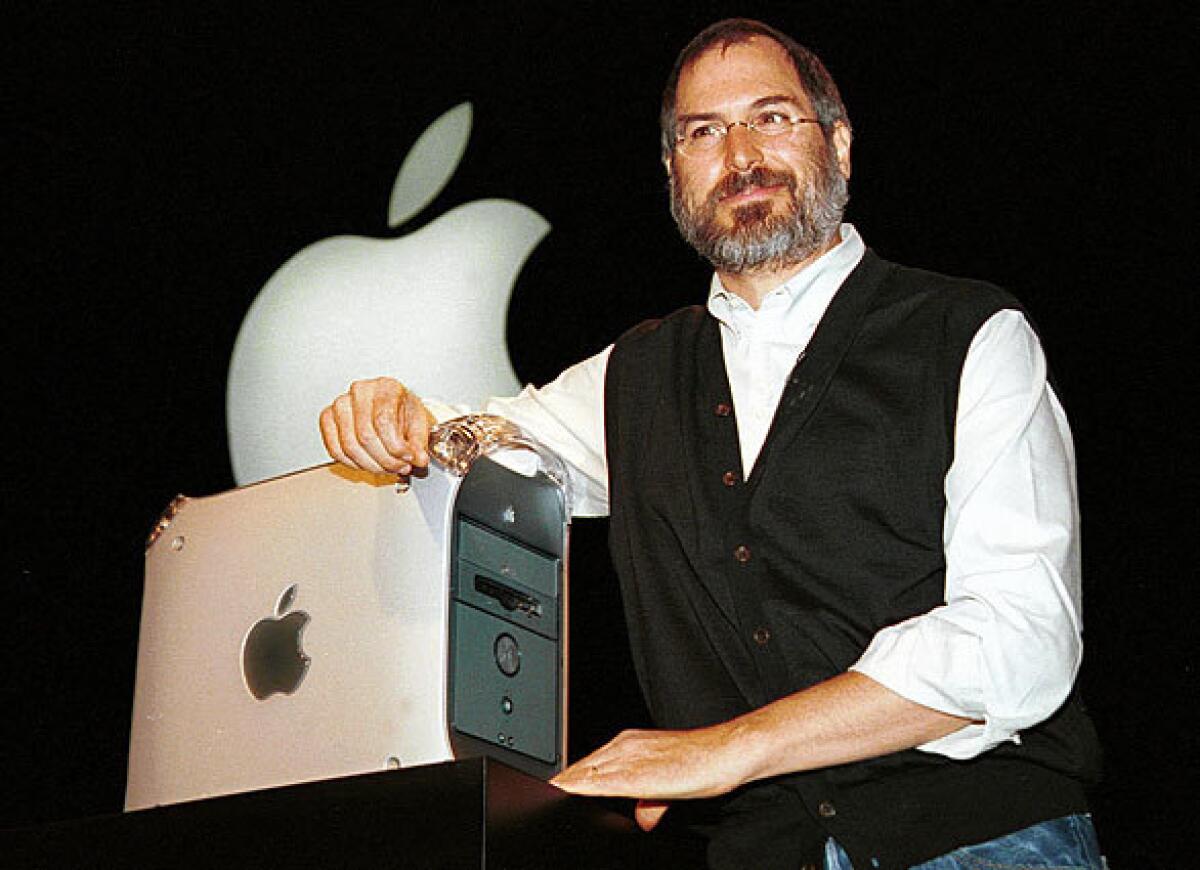

Apple

22,591%

IPO: $22 in 1980

Split adjusted: $2.75

Current value: $635

Do we wish we had bought stock when it was $14 per share in the 1990s? Yes. Yes we do.

Berkshire Hathaway

36,699%

Value: $520 on May 5, 1981

Current value: $191,356

The clear winner is billionaire Warren Buffett's company. He's so popular, he has his own clothing line.

FactSet Research Systems Inc. and Times reporting;